Liberals Love Immigration Unless Google or Amazon Wants to Move to Their Neighborhood

High taxes proposed by Alexandria Ocasio-Cortez lead to human capital flight, thus damaging local economies | Source: Stephanie Keith / Getty Images / AFP

Why does the media keep reporting on Amazon, Google, and other tech giants building new offices and data centers as if their desire to expand is an affront to basic human decency?

This article by Elizabeth Dwoskin at the Washington Post covers Google’s expansion into a new data center near Dallas, TX as if the author was a muckraker uncovering a dirty secret.

Complete Picture or Propaganda?

The story begins:

“Last May, officials in Midlothian, Tex., a city near Dallas, approved more than $10 million in tax breaks for a huge, mysterious new development across from a shuttered Toys R Us warehouse.”

The mention of the shuttered Toys R Us warehouse is no accident.

It paints a melancholic picture in which brick and mortar retail businesses are dying because of the disruption of high tech companies like Google and Amazon.

But it’s just a story a journalist is telling about companies like Google.

And it’s a very incomplete picture of what’s really happening right now. It leaves all the good these companies are doing out of the frame.

Why All the Anti-Google/Amazon Propaganda?

The article continues:

“That day was the first time officials had spoken publicly about an enigmatic developer’s plans to build a sprawling data center. The developer, which incorporated with the state four months earlier, went by the name Sharka LLC. City officials declined at the time to say who was behind Sharka.”

“The mystery company was Google — a fact the city revealed two months later, after the project was formally approved. Larry Barnett, president of Midlothian Economic Development, one of the agencies that negotiated the data center deal, said he knew at the time the tech giant was the one seeking a decade of tax giveaways for the project, but he was prohibited from disclosing it because the company had demanded secrecy.”

The Washington Post reports this like Google’s doing something shady or unfair.

Dwoskin criticizes Google for a lack of transparency in its process of expansion as it’s built 15 data centers on three continents and 70 offices all over the planet:

“But that development spree has often been shrouded in secrecy, making it nearly impossible for some communities to know, let alone protest or debate, who is using their land, their resources and their tax dollars until after the fact…”

This sentence is loaded with falsehoods.

When Alphabet, Amazon, Apple or any other company opens a new office, they don’t use someone else’s land. They pay for the land they use.

They don’t use anyone else’s resources either, not without paying for them. That’s a boon for anyone who has these companies as customers, including their customer for real estate.

When Secrecy in Commerce is Okay and Makes Sense

Transparency is one of the highest ideals of our modern, free, and open society.

We have found that those whose aims are deleterious and unacceptable to society thrive in secrecy and that people are on their best behavior when they’re being watched.

But there isn’t any good reason left for keeping secrets. No one would expect Coca-Cola to divulge the secret recipe to its popular carbonated cola beverage.

When big companies with a lot of money develop a new area with a massive infusion of resources, secrecy is in their best interests to get the best deal for their investment.

They’re not keeping anything bad secret, they’re keeping a secret of the mere fact of their intention to possibly buy land somewhere and build on it.

What information could more obviously be the rightful “property” of the person or company who knows it than what their possible plans for the future are?

It is clearly their prerogative to keep that information to themselves as long as they’d like and disclose it at a time and in a way they think is in their best self-interest.

Otherwise, when markets get wind that Google’s buying up land near Dallas, it can lead to a frenzy of speculators driving up the price of the land they’re trying to acquire.

You think when a Hollywood celebrity buys a house they just stroll into the real estate agent’s office with the paparazzi snapping photos and say, “Hi, I’m Nicole Kidman and I’d like my next real estate purchase to be the subject of endless media scrutiny?”

We all know that the media vultures swoop in to feed on stories that get their audience’s attention with little regard for the negative externalities of their own business model, and the way things can get twisted up when they become fodder for media narratives.

Maybe to some degree newspapers like the Washington Post are the reason why companies like Google have to be so cautious and secretive when working towards any kind of new project or big deal.

Transparency is certainly one of the values that is making our society work so well, but another counterbalancing value that is foundational to our way of life is privacy.

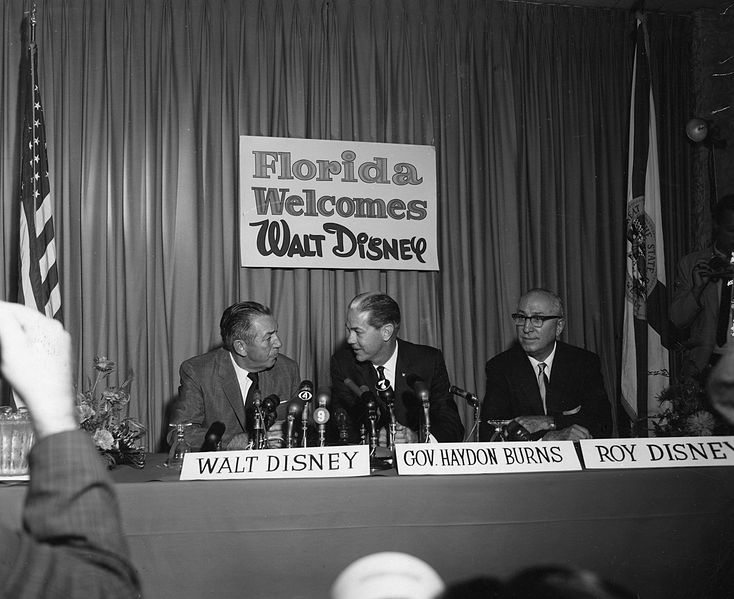

Walt Disney’s Secret Land Deal for Disney World

It’s why Walt Disney was so secretive about his big land purchase near Orlando to build Walt Disney World, which opened its doors to the public in 1971. On May 27, 1965, the Miami Herald published this headline: “Giant land deal near Orlando revealed.”

The story reported: “A Miami law firm working with $5 million in cold cash has quietly engineered one of the biggest Florida land deals in years.”

Nearly 50 square miles of land – about 30,000 acres – had been purchased by a mystery buyer and speculation abounded. Some guessed an atomic energy lab. Others Disneyland East.

When Walt Disney World opened its doors on October 1, 1971, weeks of low turnout had people thinking it was a dud, and Disney’s stock started selling at a loss.

Then on Thanksgiving, so many people went to Disney World that the park had to close its doors. Disney’s stock price shot through the roof.

When the area in view of his park began brimming over with billboards and fast food restaurants, Disney regretted that he hadn’t kept the secret for longer and bought more land.

Unfair Tax Incentives for High Tech Companies?

The main thrust of the argument against Google in the Washington Post article (and Amazon’s now cancelled HQ2 in New York City) is that these tech giants get millions in unfair tax breaks from the federal government and then again by local municipalities.

This was the argument activists led by Alexandria Ocasio-Cortez made against Amazon building HQ2 in Queens. But these businesses create more wealth and pay more taxes than most.

Google’s parent company Alphabet paid $4.7 billion in 2016.

Amazon made headlines this week for paying zero income tax to the United States for the second year in a row despite doubling its profits from $5.6 billion to $11.2 billion.

In Securities and Exchange Commission filings Amazon has disclosed that it did pay $177 million in income taxes in 2014, $273 million in 2015, and $412 million in 2016. How much has Alexandria Ocasio-Cortez or Elizabeth Dwoskin contributed to the U.S. Treasury?

So why didn’t Amazon pay any federal income tax in 2017 or 2018?

“Amazon lists two line items that likely got them here: tax credits worth $220 million and stock-based compensation worth $917 million.”

“These reflect the normal workings of the tax system, according to Annette Nellen, professor and director of the Master of Science in Taxation program at San Jose University.”

What are the tax credits for?

“Companies aren’t required to spell out which tax credits they claim in their annual report, but Nellen said they likely include write-offs for research and development, domestic production, and equipment depreciation for Amazon.”

Playing By The Same Rules As Everyone Else

So when Amazon or Google or the company you start one day invests money in specialized equipment that makes the labor of each employee more productive and more valuable (good for the employee, good for the company, good for the customer), it gets to write off the wear and tear that uses up that equipment as an expense.

Or when a company does research and development, taking a major risk to discover new valuable information to make better goods, or make them faster, or cheaper, but with no immediate or guaranteed payoff, this is an expense that is deducted from the company’s taxable income total.

These are the same tax rules everyone is allowed to play by in the United States. They’re not special rules for big companies. The U.S. government is actually making a calculation that this money will produce better results for society and overall more taxable wealth creation in the capable hands of America’s businesses.

So the next time Alexandria Ocasio-Cortez makes a tearful plea for immigration reform, someone please remind her that she just chased Amazon – and 25,000 quality jobs – out of New York city.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.

Featured Image from Stephanie Keith / Getty Images / AFP