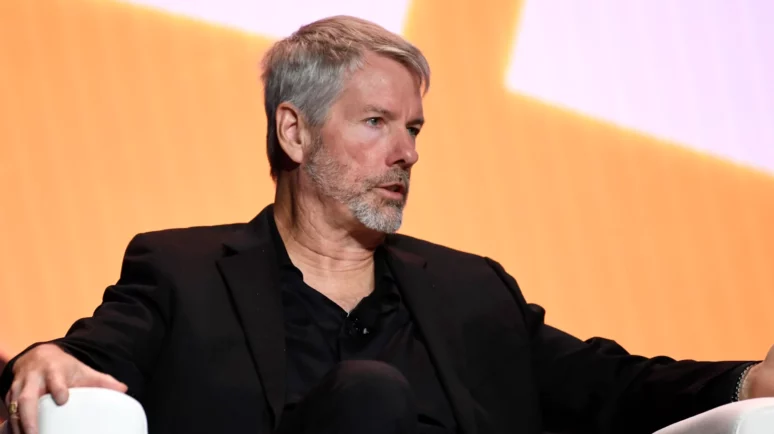

Brad Garlinghouse: XRP, Solana, Cardano ETFs “Only a Matter of Time”

The crypto ETFs are coming according to Ripple CEO Brad Garlinghouse. (Photo by Michael M. Santiago/Getty Images)

- The approval of a spot Ethereum ETF could set a precedent for altcoins vying for ETF status.

- Ripple and The SEC remain locked in a lawsuit over the status of XRP as a security.

- The SEC launched a renewed investigation into ETHs classification following the “Merge”.

Speaking at the Consensys 2024 conference, Ripple CEO Brad Garlinghouse predicted that more crypto exchange-traded funds (ETFs) are on the way.

Garlinghouse was critical of the SEC’s lack of regulatory clarity and optimistic about the prospect of an XRP ETF despite the ongoing lawsuit between Ripple and the regulator.

Altcoin ETFs “Inevitable”

The prospect of an Ethereum (ETH) ETF has caused many to speculatw which other cryptocurrencies, if any at all, could be launched as ETF products. According to Garlinghouse, XRP, Solana (SOL), and Cardano (ADA) are next in line.

Bullish as ever, Garlinghouse stated :

“I think it’s just a matter of time, and it’s inevitable there’s gonna be an XRP ETF, there’s gonna be a Solana (SOL) ETF, there’s gonna be a Cardano (ADA) ETF, and that’s great,”

Garlinghouse’s optimism about a Solana or Cardano ETF may feel a little misplaced given that the SEC named both of these tokens as unregistered securities in its cases against Binance and Coinbase.

Although there’s plenty of optimism buzzing around the Ethereum ETF, Garlinghouse expressed frustration with the substantial regulatory barriers that remain.

An XRP ETF?

Following the approval and launch of BTC ETFs in the U.S., the question immediately became “When Ethereum ETF?”. Now that we may have June/July 2024 as an answer, many are beginning to wonder which crypto will be next to “go institutional”.

If the SEC is to approve Ethereum, it would indicate that ETH is not classified as a security by the SEC, which has major implications for the likes of Ethereum-like cryptocurrencies. Ripple is a particularly popular bet for the next crypto ETF as it is a well-known, longstanding crypto and blockchain designed for institutional adoption.

Unfortunately, this could be complicated as Ripple and the SEC are locked in a lengthy legal battle over the sale of XRP. If an XRP ETF were to go ahead, it would need the SEC’s approval, which seems unlikely as the SEC would have to admit that XRP is not a security.

Oddly, the SEC decided to launch an investigation into whether or not the Ethereum Foundation broke securities laws following the “Merge” in 2022. Seemingly, Ethereum’s switch to proof-of-stake (PoS) has given the SEC a new avenue to interrogate Ethereum’s status as a security.

Perhaps the launch of Ethereum ETFs has greater implications for altcoins than first thought, and they could ultimately pave the way for the SEC to consider approving other crypto ETFs.

Solana (SOL) and Cardano (ADA) ETFs?

His prediction certainly raises some questions around the SEC’s ongoing lawsuits against Ripple and Coinbase, in which both SOL and ADA are considered to be unregistered securities by the SEC. Garlinghouse adds:

“Gary Gensler has been called to Congress, and when asked if ether is a security, he won’t answer the question. Yet, he insists that the rules are very clear and don’t need updating,”

Though Garlinghouse’s comments are exceptionally bullish for the SOL and ADA community, the regulatory hurdles may take some time to overcome, largely due to the SEC’s legal battles with Binance and Coinbase, as pointed out by seasoned finance lawyer Scott Johnson .

Expert ETF analyst James Seyffart seemed to agree, stating the SEC is likely to block any efforts to legitimize SOL as a financial asset. If anything, Solana will need to achieve a more decentralized status similar to Ethereum on its path to an ETF.

Cardano may have a better shot at becoming an ETF than other altcoins as it is already traded in the Swiss-based 21Shares Cardano ETP (AADA ). It is also included in the Grayscale Digital Large Cap Fund (GDLC ) portfolio, as well as Bitwise Investments’ “Bitwise 10 Crypto Index Fund” (BITW ).

Naturally, these developments diverge from the norm and signal that institutional investors already consider ADA to be a promising investment. This lesser-known fact about ADA could mean it’s already on its way to becoming an ETF.

Centralized Ethereum?

As CCN previously reported, an estimated 8.3% of every BTC token in circulation – or every 1 in 12 – have been purchased by ETFs, raising concerns over Bitcoin’s ever-increasingly centralized supply.

Consider this, Ethereum currently has a token supply of 120.13 million. ETH is trading at a price twenty times lower than BTC which has a total circulating supply of 19.7 million BTC tokens. ETF issuers could effectively purchase even greater portions of Ethereum’s total supply for an even cheaper price.

Institutional appetite for BTC ETFs has been gigantic, and there’s no reason to see why ETH ETF issuers won’t hoover up as much of the supply as they can.

BlackRock Files S-1: Spot Ethereum ETF by June?

Momentum is gathering around the prospect of spot Ethereum exchange-traded funds (ETFs) launching in June as BlackRock files its updated Form-S1 for its proposed fund with the U.S. Securities and Exchange Commission (SEC).

On May 29, BlackRock filed an amended version of its spot Ethereum (ETH) ETF S-1 application which was initially filed in November 2023. This comes just a week after the SEC approved BlackRock’s 19b-4 filing, but both need to be approved before trading can begin.

As per the filing, BlackRock’s iShares Ethereum Trust will have the ticker ETHA . Furthermore, the fund has generated $10 million in seed capital, raised from a purchase by BlackRock Financial Management of 400,000 shares at $25 a piece.

Though details on fees remain yet to be seen, the S-1 does reintroduce the possibility of in-kind creation and redemptions. This is significant as it would allow for cryptocurrency transactions instead of cash, we would skip generating taxable gains, a huge plus for investors.

Bloomberg ETF analyst, Eric Balchunas, sees this as a “good sign ” and expects the remaining applications to follow suit. He believes they could launch at the end of June, or July 4th at best.

Though, as Balchunas points out, there is still at least one more round of fine-tuning and feedback to go.